In today's increasingly interdependent world economy, fiscal policy decisions made by sovereign governments can have substantial ramifications on the global stage. Domestic economic policies, such as changes in monetary policy, can ripple throughout international markets. This interconnectedness presents both challenges and opportunities for policymakers worldwide.

- One of the primary difficulties faced by governments is the potential for unintended consequences when implementing fiscal policies. A country's efforts to stimulate its domestic economy, for example, could lead to increased inflation in other countries or even trigger a currency devaluation crisis.

- Conversely, coordinated global fiscal policies can be instrumental in addressing transnational economic issues such as financial crises and unemployment. Effective international cooperation is essential for addressing these challenges

As a result, policymakers must carefully consider the broader global context when formulating fiscal policies. This involves collaborating with other nations, monitoring economic trends in different regions, and striving for policy alignment that promotes both national prosperity and global stability.

Political Polarization's Economic Impacts

Political polarization has become a pervasive feature of many democracies, raising concerns about its detrimental consequences for economic stability. Economists argue that polarization can weaken trust in institutions, restrict effective policymaking, and fuel social unrest, all of which have detrimental effects on economic prosperity. Furthermore, polarization can cause gridlock among policymakers, making it difficult the enactment of policies that address pressing economic challenges.

Inequality: A Threat to Economic Growth and Democracy

Widespread disparities poses a grave risk to both development and the very fabric of self-governance. Excessive wealth accumulation erodes the foundation of a fair and effective society, where opportunities are get more info accessible to all. When a significant portion of the population lacks basic needs, it hampers innovation, investment, and overall economic performance. Moreover, inequality breeds social unrest, political instability, and a weakening in public faith, ultimately imperiling the very principles upon which self-governance are built.

Balancing Markets and Interventions

Navigating the complex interplay between market forces and government regulation is a continual challenge. Advocates for reduced government influence argue that unfetteredenterprise foster efficiency, while proponents of active government regulation maintain that it is necessary to counteract market inefficiencies. Finding the optimal equilibrium remains a subject of debate, with no easy outcomes.

Moreover, the nature of government regulation can change significantly across areas and countries. Considerations such as social values play a crucial part in shaping the suitable level of government involvement.

Navigating the Labyrinth of International Trade Agreements

International trade agreements establish a complex framework for global commerce, often characterized by intricate regulations and conferences. Companies seeking to venture in international markets must carefully analyze these agreements to reduce potential risks and maximize opportunities. A comprehensive understanding of trade terms, fees, and sanctions is essential for prosperity.

- Navigating the labyrinth of international trade agreements requires a multifaceted approach, encompassing legal expertise, market analysis, and strategic planning.

- Locating expert guidance from consultants or trade associations can become invaluable in interpreting the complexities of these agreements.

- Cooperation with other businesses and stakeholders can also simplify the system of navigating international trade agreements.

Monetary Actions and its Impact on Public Opinion

Central banks implement monetary policy to influence interest rates, money supply, and overall economic activity. These actions can have a profound impact on public sentiment. When monetary policy is perceived as effective, it can lead to increased optimism in the economy. This positive sentiment can fuel consumer spending, investment, and economic growth. Conversely, if monetary policy is seen as problematic, it can erode public confidence and lead to a pessimistic outlook on the future.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Marla Sokoloff Then & Now!

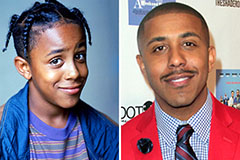

Marla Sokoloff Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now!